U.S. federal direct loan program

Processing of U.S. Direct Loans can take up to 4 weeks after a complete application, required documents, and course registration has been completed.*

*Please note that applications completed or submitted after October 15th, 2025 will be processed however, students will only receive their funding in February, 2026.*

Applying for U.S. Federal Student Aid to attend a school outside the U.S. involves a slightly different process than applying for aid at American schools. Documents are not automatically sent to Concordia, and you must complete an additional e-form.

Concordia U.S. Loans Federal Code: G08365

*As of July 1st, 2026, there will be new regulations in effect that will result in changes to U.S. Federal Direct Loan Program*

Changes to the US Federal Direct Loan Program

| Loan Program | Change (OBBB Policy) | Legacy (Grandfathered) Provision | Effective Date |

| Graduate PLUS Program | Elimination of Graduate PLUS program. | Once students borrow the $20,500 annual loan limit, they may borrow the remainder of their Cost of Attendance through a Graduate PLUS loan with no annual or aggregate limits. | July 1, 2026 |

| Graduate Annual & Aggregate Loan Limits | Caps annual loan limit for graduate students to $20,500 unsubsidized and aggregate is capped to $100,000. Does not include loans borrowed at the undergraduate level. | Annual loan limit for grad students to $20,500 unsubsidized and aggregate is capped to $138,500. Includes loans borrowed at undergraduate level. | July 1, 2026 |

| Federal Loan Lifetime Limits | Lifetime loan limit on all federal student loans is $257,500. | Current Limits: $57,500 for undergraduates. Max $23,000 of this amount may be in subsidized loans. $138,500 for graduate students. The graduate aggregate limit includes all federal loans received for undergraduate study. | July 1, 2026 |

| Parent PLUS Annual & Aggregate Loan Limits | Parents (combined) may only borrow annual limit of $20,000 per year per student, and aggregate limit is set at $65,000 per student. | Parents may borrow the balance of a student’s COA with no annual or aggregate limits. | July 1, 2026 |

| Loan Proration (Annual Loan Limits Based on Enrollment Status) | Schools must reduce loans for all students enrolled in a program of study on a less-then-full-time basis during an academic year. Students who are not enrolled full-time will have limited borrowing ability. | None – applies to all students. | July 1, 2026 |

Important Provisions

For a student or parent to remain grandfathered they must:

1-) Have borrowed some type of Direct Loan as of June 30, 2026

AND

2-) The student must continue to be enrolled at the same school in the same program

A graduate or professional student who had not yet borrowed a Direct PLUS Loan but did borrow a Direct Unsubsidized Loan by June 30, 2026, qualifies to borrow a PLUS loan for the first time after July 1, 2026.

As long as the student borrowed in one of the Direct Loan programs by the cutoff date and remains in the same program of study at the same school, the graduate or professional student retains the ability to borrow Direct PLUS Loans for the lesser of three academic years or the difference between the program length the student is enrolled in minus the period the student has already completed.

A parent would be grandfathered into the current parent PLUS loan limits if he/she had borrowed on behalf of the dependent student by June 30, 2026, or if that student had borrowed Direct Subsidized or Unsubsidized Loans by the cutoff date.

The student on whose behalf the parent is borrowing must remain in the same program of study at the same school.

FAQ for Prorating

Federal student loan rules now require reduced annual loan limits for students who are not enrolled full time.

Any student enrolled on a less-than-full-time basis for part or all of the academic year.

Yes. If your enrollment status changes, your loan eligibility may be reassessed and adjusted.

U.S. Direct Loan Consumer Information

Per the Higher Education Opportunity Act (HEOA) of 2008, the U.S. government requires all institutions certified to disburse Title IV Aid to disclose the following consumer information. Download U.S. Direct Loan Consumer Information (PDF) Please contact the Financial Aid and Awards Office (FAAO) at fundingyoureducation@concordia.ca if you require any additional information.

Questions?

For support related to U.S. Federal Direct Loan program, contact the Financial Aid and Awards Office (FAAO).

Eligibility

At Concordia University, only programs leading to a bachelor’s, master’s, or PhD are eligible for U.S. Direct Loans. Students should verify that their degree program is eligible.

Please note independent studies, diplomas, and certificates are not eligible for U.S. Direct Loan funding.

To be eligible for U.S. Direct Loans, you must be registered in a minimum of 6 credits per semester. Waitlisted courses do not count toward your total credits.

International students are expected to maintain a full-time course load (12 to 15 credits per semester) as a condition of immigration requirements. If you plan on studying less than full time, you should contact the International Students Office (ISO) to ensure you do not have any difficulties with Immigration Quebec or the Department of Immigration, Refugees and Citizenship Canada (IRCC).

As a Title IV Foreign Institution, our office must abide by the laws of Title IV Aid as mandated by the U.S. Federal Government. For recipients of Direct Loan funding, this means that the version of the program in which you are accepted cannot include the following:

Any use of a telecommunications course, correspondence course or direct assessment (CFR 600.51 (d)).

Any student that takes any online course(s) is ineligible to receive Direct Loan funding for the duration of their program.

As such, students receiving Title IV Aid must register for on-campus courses only throughout their academic career at Concordia. Should you register in any ineligible course as outlined above, you are automatically considered to be in an ineligible program and will immediately become ineligible for Title IV Aid. There is no appeal for this requirement.

You are encouraged to discuss your study plans with a Financial Aid Advisor before registering.

U.S. Federal regulations require that the University evaluate the academic progress of all Title IV student loan recipients from the first date of enrolment at Concordia University, whether or not loans were received at that time. Credits transferred from all other institutions will be considered as attempted and completed credits in the evaluation of the completion rate standards, but these courses do not affect the calculation of your GPA.

Concordia University Requirements for Satisfactory Academic Progress

To be eligible for Title IV Aid, you must meet Concordia University's institutional requirements for minimum satisfactory performance. These are defined in the Undergraduate Calendar (Section 16.3) and the Graduate Calendar (Section – Academic Regulations) and will also be reiterated under each Faculty's section. Note that you must maintain a minimum annual GPA of 2.0 in all Undergraduate Faculties and 3.0 for Graduate Faculties.

DISC, INC, MED, DEF, AU, F/FNS/R/NR & S Grades, and repeated course work will be treated as follows:

- Course withdrawals (DISC) after the drop/add period are not included in the GPA calculation but are considered as non-completion of attempted course work.

- Incomplete (INC) indicates that you have not completed required course work, and that the instructor has agreed to accept the work after the due date. The notation is always used in combination with a letter grade such as B/INC and the grade is used in the calculation of the various GPAs.

- Medical (MED) indicates that you have been unable to write a final examination or complete other assignments due to a long-term medical situation. A MED notation carries no grade point value.

- Deferred (DEF) indicates that you have been unable to write a final examination. A DEF notation carries no grade point value.

- An audit (AU) grade is not considered attempted course work. It is not included in the GPA calculation or completion rate determinations.

- F/FNS/R/NR grades are treated as attempted credits that were not earned and so are included in both the calculation of GPA and minimum completion rate.

- A satisfactory grade (S) is treated as attempted credits that are earned but is not included in calculation of GPA.

In case of repeated courses, only the grade corresponding to the latest attempt of the course will be used in calculation of the various GPAs, but every repeated attempt will be included in the completion rate determinations. No loans can be disbursed for a repeated attempt if you have already achieved a passing grade for that course. The University's policy means that you receive aid for only one repeat of a course.

Satisfactory Academic Progress for Title IV Aid Recipients

The following policy applies to Title IV Aid recipients who are full-time, quarter-time or part-time in undergraduate or graduate level studies in Title IV Aid-eligible programs. As a Title IV Aid recipient, you are required to be in good standing, maintain satisfactory academic progress toward your degree requirements for each semester in which you are enrolled, and complete your degree in the prescribed period according to your program. Satisfactory Academic Progress (SAP), as described below, is evaluated on an annual basis in June. Note, that SAP for Title IV aid recipients is stricter than the University’s regulations as pace of progression, maximum timeframe completion in addition to academic performance are measured. Failure to maintain satisfactory academic progress may result in the loss of your Title IV Aid eligibility.

Satisfactory Academic Progress Requirements

To achieve SAP per the U.S. Federal Student Aid regulations, students must:

- Maintain a minimum annual GPA of 2.0. (undergraduates) and 3.0 (graduate students) AND

- Maintain a minimum cumulative completion rate of two-thirds of credits attempted (67%).

Furthermore, for students enrolled in an educational program of more than two academic years, must have a minimum Cumulative GPA of 2.0 or have the academic standing consistent within their faculty’s published requirements for graduation.

Maximum Timeframe

The FAAO will ensure that students are completing their educational program within a timeframe no longer than 150% of its published length. For example, a student must complete their program after attempting a maximum of 180 credits for a 120-credit program.

All attempted credits will be counted towards the student's maximum timeframe. The student fails to meet the maximum timeframe component at the point in which it is determined that it is not mathematically possible for the student to complete within the maximum timeframe, not at the point they reach the maximum timeframe.

The following administrative notations count towards a student’s attempted credits and maximum timeframe: CODE, DEF, DISC, DNW, EXCL, EXTR, INC, INIT, MED, PEND, PTR, RPT, SRCR, SREP, SUPP, TRC, VALD, WRKT.

Per Title IV regulations, courses in which a students remained enrolled past the add/drop deadline cannot be excluded from a student’s SAP evaluation. Therefore, courses in which a late withdrawal (DNE or DISC) was granted, with or without tuition refund, will be counted towards the maximum timeframe as attempted credits.

Pace of Progression

Example of ideal pace of progression (attempted and completed) for an undergraduate student:

0-30 credits = year 1

30-60 credits = year 2 (with a minimum Cumulative GPA of 2.0 or more)

60-90 credits = year 3

90-120 credits = year 4

For the purposes of calculating a student pace of progression, the FAAO will divide the total number of credits successfully completed by the number credits attempted.

Example: A student passed 15 credits of an attempted 24 credits.

15/24 = 62.5% - this indicates the student did not make academic progress.

For graduate students, the maximum timeframe will be defined by the School of Graduate Studies upon admission and will be monitored and evaluated on an annual basis.

Student Loan Denied Status

If you fail to meet the minimum 2.0 (or 3.0) annual or cumulative GPA standard or fail to complete at least two-thirds of cumulative credits attempted, you will immediately lose your eligibility for Title IV Aid and be placed on Student Loan Denied status. No Title IV Aid will be disbursed unless you have submitted an appeal, and the appeal has been granted. There are no exceptions to this regulation.

If you fail to satisfy the 150% maximum timeframe requirement, you will also be placed on Student Loan Denied status. No Title IV Aid will be disbursed unless you have made an appeal, and the appeal is granted. There are no exceptions to this regulation. If you are in a 120-credit bachelor’s degree program and have attempted in excess of 180 credits, including transfer credits, you are no longer eligible for Title IV Aid.

All Title IV Aid recipients who fail the any of the above SAP standards will be notified by email within one (1) week of the determination to advise they have been placed on Student Loan Denied status and given a specific date to submit their appeal (if applicable).

Reinstatement of Aid After Student Loan Denied Status

Reinstatement of financial aid after you have been placed on Student Loan Denied status may be achieved in one of the following ways:

- You attend Concordia University for one academic year and register for a minimum of 12 credits and do well enough in your course work to meet all the SAP standards. You can regain aid eligibility on probationary status.

- You submit a written appeal in accordance with the appeal process. If the FAAO grants the appeal, you will then be placed on Student Loan Probation for ONE payment period. You must attain a minimum 2.0 term GPA in that payment period to qualify for the second disbursement. Your next academic evaluation will use the term GPA of the 1st payment period of the aid year. This evaluation will normally be done in September, January or June, after which time if your GPA is not above the 2.0 minimum or pace of progression has not been attained, you will immediately be placed on US Student Loan Denied status and become ineligible for any further Title IV Aid until all of the above noted SAP requirements have been met.

Appeal Process

You may appeal your Student Loan Denied status if it can be determined that an unusual or extraordinary situation affected your academic progress. An example of an unusual or extraordinary situation would be a death in the family or a serious illness.

Appeals must:

- Be submitted in writing to the FAAO's Director and/or your Financial Aid Advisor by the date specified in the Student Loan Denied notification letter.

- Contain documentation that supports your unusual or extraordinary situation (i.e., death of a family member is supported by a death certificate). In addition, your statement must include a specific plan for your academic recovery.

- Explain what has changed in your situation that will allow you to meet the SAP requirements at the next evaluation.

Should you require additional information regarding this process, please visit the FAAO.

Students participating in a Study Abroad program and paying tuition and fees at another institution are not eligible to receive U.S. subsidized/unsubsidized/PLUS or alternative loans through Concordia. You must make arrangements with the institution you have chosen to attend for your financial aid.

Application deadlines for 2026-2027

Applications for the 2026-2027 academic year are now open.

| Term | Application Deadline |

|---|---|

| Summer 2026 | April 15, 2026 |

| Fall 2026 | June 8, 2026 |

| Winter 2027 | October 26, 2026 |

Our office will make every attempt to process your financial aid application as quickly as possible. However, if your application is submitted after the deadline, we cannot guarantee your funding will arrive by Concordia’s payment due date.

Available loans

The U.S. Department of Education will consider you independent if you meet one or more of the following criteria:

- You will be at least 24 years old by December 31st of the award year.

- You are an orphan or ward/dependent of the court, or were a ward/dependent of the court until you reached age 18.

- You are a veteran of the U.S. Armed Forces.

- You will be working on a master's or doctorate program at the beginning of the award year for which the FAFSA is completed.

- You will be married as of the date the FAFSA is completed.

- You have at least one child who receives more than half his or her support from you.

- You have a dependent, other than a spouse or a child, who lives with you and receives more than half of his or her support from you at the time the FAFSA is completed and through June 30th of the award year.

You are considered dependent if you do not meet any of the preceding criteria for an independent student unless the FAAO determines that you are independent on the basis of special circumstances.

The federal Pell Grant and the TEACH Grant Program are not available to students attending foreign schools.

Students may receive funding under the U.S. Direct Loan Program. The loans available include Subsidized, Unsubsidized and PLUS loans.

Dependent students

| Year | Dependent students (Except students whose parents are unable to obtain PLUS Loans) |

|---|---|

| First-Year Undergraduate | $5,500 USD —No more than $3,500 USD of this amount may be in subsidized loans. |

| Second-Year Undergraduate | $6,500 USD —No more than $4,500 USD of this amount may be in subsidized loans. |

| Third-Year and Beyond Undergraduate | $7,500 USD per year—No more than $5,500 USD of this amount may be in subsidized loans. |

| Graduate or Professional Degree Students | Not Applicable |

| Maximum Total Debt from Subsidized and Unsubsidized Loans | $31,000 USD —No more than $23,000 USD of this amount may be in subsidized loans. |

Independent students

| Year | Independent students (and dependent undergraduate students whose parents are unable to obtain PLUS Loans) |

|---|---|

| First-Year Undergraduate | $9,500 USD —No more than $3,500 USD of this amount may be in subsidized loans. |

| Second-Year Undergraduate | $10,500 USD —No more than $4,500 USD of this amount may be in subsidized loans. |

| Third-Year and Beyond Undergraduate | $12,500 USD per year—No more than $5,500 USD of this amount may be in subsidized loans. |

| Graduate or Professional Degree Students | $20,500 USD - Unsubsidized ONLY |

Maximum Total Debt from Subsidized and Unsubsidized Loans The information provided below applies to grandfathered student only (see Changes to the US Federal Loan Program) |

$57,500 USD for undergraduates—No more than $23,000 USD of this amount may be in subsidized loans. $138,500 USD for graduate or professional students—No more than $65,500 USD of this amount may be in subsidized loans. The graduate debt limit includes all federal loans received for undergraduate study. |

U.S. Direct PLUS Loans

The U.S. Department of Education makes Direct PLUS Loans to eligible parents and graduate or professional students. The maximum PLUS Loan amount that a parent or graduate and professional degree student can borrow is your cost of attendance as calculated by the University minus any other financial aid you receive.

Federal PLUS Loans are available for parents who meet certain credit guidelines and whose child is a dependent undergraduate student as defined by the U.S. Department of Education. Eligibility is not based on financial need. Parents may use this loan to pay up to $20,000 per year of a student’s Cost of Attendance minus any other financial aid received by their dependent undergraduate student. Repayment is due to commence within 60 days after the loan is fully disbursed, although deferment of payment may be available through select lenders. This loan does not have a grace period.

***NEW*** All parents (combined) may borrow $20,000 per year per dependent student and a $65,000 aggregate limit per dependent student (without regard to amounts forgiven, repaid, canceled, or discharged).

Apply online here: Direct PLUS Loan Application for Parents.

Note: Before applying for a parent PLUS Loan, make sure your child has filled out the FAFSA form.

If you are eligible for a parent PLUS Loan, you will be required to sign a Direct PLUS Loan Master Promissory Note (MPN), agreeing to the terms of the loan.

Concordia will first apply PLUS Loan funds to the student’s school account to pay for tuition, fees, and other school charges. If any loan funds remain, Concordia will send you a refund cheque that you can use to help pay other education expenses for the student. With your authorization, the school can pay the remaining loan funds directly to the student. Your dependent student must attach a copy of the Parent Funding Release Form to their Concordia USLA e-form.

***NEW*** The OBBBA eliminates Direct PLUS Loan program eligibility for graduate and professional students for any new period of instruction beginning on or after July 1, 2026.

Federal Graduate PLUS Loans are available for graduate and professional students. Graduate students may borrow this loan to cover the difference between the Cost of Attendance and all other awarded aid after applying for other Federal aid. This loan has a federal credit check process. The review looks for bad credit only. You do not have to meet other financial standards as with other private alternative loans. Repayment is due to commence within 60 days after the loan is fully disbursed, although deferment of payment may be available. This loan does not have a grace period.

Application process

- Accept your offer of admission to Concordia University

- Complete your FAFSA (Free Application for Federal Student Aid) to make sure you are eligible for Federal Student Aid. This should be done as early as possible.

- Book your appointment for Academic Advising with your faculty. You must be admitted, registered in an eligible program, and enrolled in classes to receive funding. Registration opens in March for most programs.

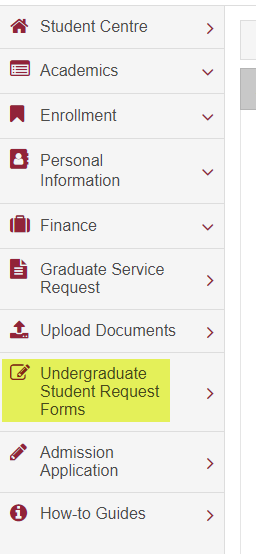

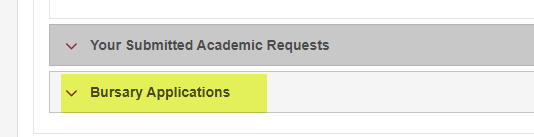

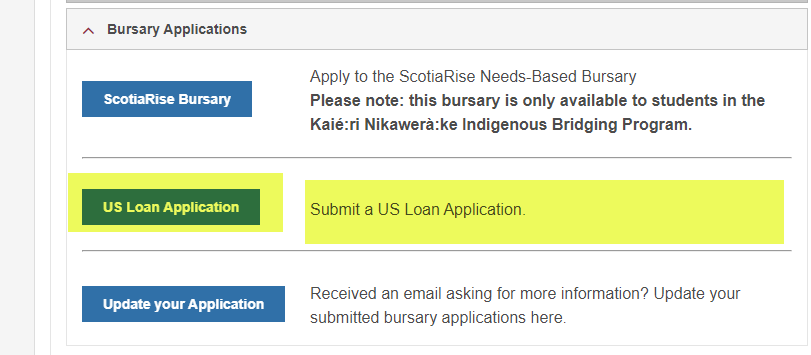

- Provide your Program Information by completing the Concordia USLA e-form: Log into your Student Hub, Go to My CU Account, Select Student Centre, Go to Undergraduate Student Request Forms, Bursary, Applications and then US Loan Application

In the Student Center

Click on Bursary Applications

Then Click on US Loan Application

- Complete a Direct Loan Master Promissory Note (MPN). An MPN is a binding legal document in which you agree to repay your loan under certain terms. Borrowers outside of the U.S. need to submit an MPN every year.

- If you are a first-time borrower at Concordia University, you will need to complete online Entrance Counselling.

- If you are in your final year OR you have accumulated the credits required to graduate, you will need to complete online Exit Counselling, even if you haven’t yet applied for graduation.

- Compete the Annual Student Loan Acknowledgment form. It is recommended that you complete it each year you accept a new federal student loan.

- Let the FAAO know if you need proof of funding letter for your Study Visa and Certificate of Acceptance to Quebec (CAQ). Your loan must be fully processed by our office before we can issue one to you.

- Submit your immigration documentation.

- Contact the International Students Office for more information.

The Cost of Attendance (COA) is determined by the school and is the maximum cost calculated of the program, program level and the number of credits you are taking. The allowable expenses calculated are for compulsory fees per credit/term (including health insurance), cost of books and supplies per term/credit, living expenses, and computer expenses.

Other necessary and reasonable expenditures that don't fall into the above categories, such as the purchase of a new computer or a return trip home, may also be included in the calculation if approved by a Financial Aid Advisor and if you can provide proof of purchase.

Once all your costs have been assessed, the COA is calculated in Canadian dollars and then converted to U.S. dollars based on the exchange rate of that day.

The FAAO, in accordance with federal regulations, establishes a standard student COA for all aid recipients based on expected tuition and other campus fees, average housing costs, average book and supply expenses, and average transportation costs. However, adjustments may be made depending on your situation. Please contact your Financial Aid Advisor for more information. Please note that any requests to adjust your COA calculation must be accompanied by supporting documentation.

After you apply

After receipt of your application, our office will assign you a Financial Aid Advisor who will:

- Review your file and send you an email to let you know if you are missing information or documents.

- Calculate your Cost of Attendance (COA) for the semester(s) in which you are fully enrolled.

- Determine the maximum amount of financial aid that you are eligible to borrow.

- Email you this information in a Notification of Financial Aid Offer. If your parents have applied for a Plus Loan, they will also receive notification.

- All borrowers must reply directly to their Notification of Financial Aid Offer email to confirm how much they wish to borrow.

In the Direct Loan program, the U.S. Department of Education sends all funding to Concordia via electronic transfer.

Your FSA funds are disbursed to your Concordia student account on a per semester basis after the University’s posted add/drop date. For example, if you are enrolled in the Fall and Winter semesters, you will receive two disbursements: one per semester.

You will receive an email from the FAAO confirming that your funds have arrived at Concordia University.

Once your tuition and fees have been deducted from your loan and if there is a credit remaining on your student account, you will be issued a refund cheque. The cheque will be issued in Canadian funds.

The FAAO will notify you when and where it will be available to be picked up.

Please note that the U.S. exchange rate used is the one in effect the day the loan is posted to your student account.

It is recommended that you open a Canadian bank account so you can deposit University-issued cheques, pay bills, and access your funds. Many banks will allow you to apply for a bank account online, so you can start the process before you get to Montreal. Here are the websites of several banks with branches near Concordia:

Repay Your Loan

Your obligation to repay becomes legally binding when you sign the Master Promissory Note (MPN) and authorize the electronic transfer of funds to your student account. Your requirement to repay does not go away because you haven’t completed your educational program, cannot find employment, were not satisfied with the education or other services your received from the University, or were notified that your loan was sold to another party by your lender.

Minimum Payment

A minimum monthly loan payment is required. This minimum amount varies depending on the amount you borrowed and your repayment plan.

Pay on Time

You must make your payments on time unless you have made special arrangements with the lender or servicer. Many lenders offer repayment incentives to reward you for paying on time.

Withdrawing from the University

If you withdraw from the University, you may be required to repay part of or all your loan(s).

You may also owe the University any loan funds returned on your behalf. The U.S. Department of Education regulations state that a school must return loan funds if a student has not completed a minimum of 60% of the payment/enrolment period. If you received more loan funding than was "earned," the excess funds must be returned by the school and/or the student. The amount of money to be returned is determined by a specific formula that is used in a calculation called a "Return to Title IV." If you did not receive all the funds that were earned, you may be eligible for a post-withdrawal disbursement. Further information is available here:

Download the Return of Title IV (R2T4) Policy (PDF)

Notify the Lender/Loan Servicer

You must notify your Lender/Loan Servicer of any changes to your situation. This includes your name, address, contact information, driver's license number or Social Security Number. You must also inform them if you withdraw from the University or drop below half-time status. You can find your Lender/Loan Servicer by logging in to the FSA website and visiting your My Aid page.

To find out who your loan servicer is:

- Visit your account dashboard and scroll down to the “My Loan Servicers” section, or

- Call the Federal Student Aid Information Center (FSAIC) at 1-800-433-3243.

As an eligible educational institution, Concordia University can only provide Canadian federal (T2202A) and Quebec provincial (RL-8) tax receipts. If you are filing taxes in the U.S., you can use the information on the T2202A, along with Concordia’s EIN (Employer Identification Number) 98-1422233. You will require this information to complete your U.S. income tax returns.

Award year: The 12-month period during which you attend the University, and for which your aid has been awarded.

Capitalization: The process by which interest is added to the principal loan amount if you choose not to make interest payments while at the University or are in forbearance. This process increases the amount that must be repaid and will make your monthly payment larger.

Cost of Attendance (COA): The total amount it will cost you to go to school. This amount includes tuition fees, living expenses, books, insurance, travel and transportation. The COA is determined by the FAAO, using U.S. guidelines.

Default: The failure of a borrower to repay the loan under the terms of the promissory note. If your repayment instalments are monthly, you are considered in default if you do not pay for 270 consecutive days. If your instalments are less frequent, default is declared after 330 consecutive days of non-payment.

Deferment: The temporary postponement of loan payments. If you’re enrolled in an eligible college or career school at least half-time, in most cases your loan will be placed into a deferment automatically. If you enroll at least half-time but do not automatically receive a deferment, you should contact the FAAO.

Delinquency: The status of a loan when payment is late. Delinquency can lead to default.

Disbursement: The lender's payment of loan funds to the University. Disbursement is usually made in two or more instalments during the year in accordance with U.S. Department of Education regulations.

Forbearance: The temporary postponement or reduction of payments because of the borrower's financial difficulties. Forbearance may also be an extension of the repayment period. You are charged interest during forbearance.

Free Application for Federal Student Aid (FAFSA): The application that you must file to apply for financial aid. The FAFSA is printed and distributed free of charge by the U.S. Department of Education. It is available online.

Full-time: Enrolment in 12 or more credits per semester.

Grace period: A period of time between when you graduate or drop below half-time status and when repayment begins. For Direct Loans, the grace period is six-months. There is no grace period for PLUS Loans. If you re-enter school at least half-time during your grace period, the grace period is renewed for another six months. Therefore, you have the full grace period available when you leave school again. However, if you use all your grace period at once and re-enter school, you will not be eligible for another grace period.

Interest: The fee that is charged by the lender in exchange for lending the money, the interest rate, usually expressed as a percentage of the loan amount, may stay the same for the term of the loan (fixed rate) or it may change periodically (variable rate). Interest rates for Direct Loans are fixed, whereas those of alternative loans may vary.

Master Promissory Note (MPN): A legally binding contract that you sign, thereby agreeing to repay the loan. It contains the loan terms and conditions, including how and when the loan must be repaid.

Principal: When you borrow money for a loan, the principal is the total amount that was lent before any interest or fees are added. Outstanding principal refers to the remaining amount of the original loan, plus any capitalized interest.

Student Aid Index (SAI): The amount that you and family are expected to contribute toward the Cost of Attendance. This amount is based on your or your family's income and assets.

Subsidized Loan: A loan made based on financial need. The federal government pays the interest on these loans while you are enrolled at least half-time, during the grace period, or during authorized periods of deferment.

Three-Quarter time: Enrolment in 9 to 11.75 credits per semester.

Unsubsidized Loan: A loan not based on financial need. You are responsible for paying all interest that accrues throughout the life of an unsubsidized loan. During in-school status, deferment, and forbearance periods, you may choose to pay the interest charged on the loan or allow the interest to be capitalized.

Withdrawn: A student is considered to have withdrawn from a payment period or period of enrollment if, in the case of a program that is measured in credit hours, the student does not complete all the days in the payment period or period of enrollment that the student was scheduled to complete.

Contact us

As a U.S. Loan recipient, you will be assigned a Financial Aid Advisor to help you find ways to plan your finances and navigate the funding opportunities available to help you pay for your education.

If you are unsure who to contact at our office, please email us at fundingyoureducation@concordia.ca

Location

SGW Campus Financial Aid and Awards Office 1550 De Maisonneuve Blvd. W. GM 230.00 (see map)

Mailing address

Financial Aid and Awards Office 1455 De Maisonneuve Blvd. W. Room GM-230 Montreal, QC H3G 1M8

Hours of service

Operating Hours: Monday to Friday 9 a.m. - 5 p.m.

Walk-in Hours: Monday to Friday 10 a.m. - 4 p.m.

Contact

Tel: 514-848-2424, ext. 3507

Email: fundingyoureducation@concordia.ca