National non-profit seeks new mentors to lead financial literacy workshops geared at youth

Many young people graduate from high school unprepared to navigate their personal finances.

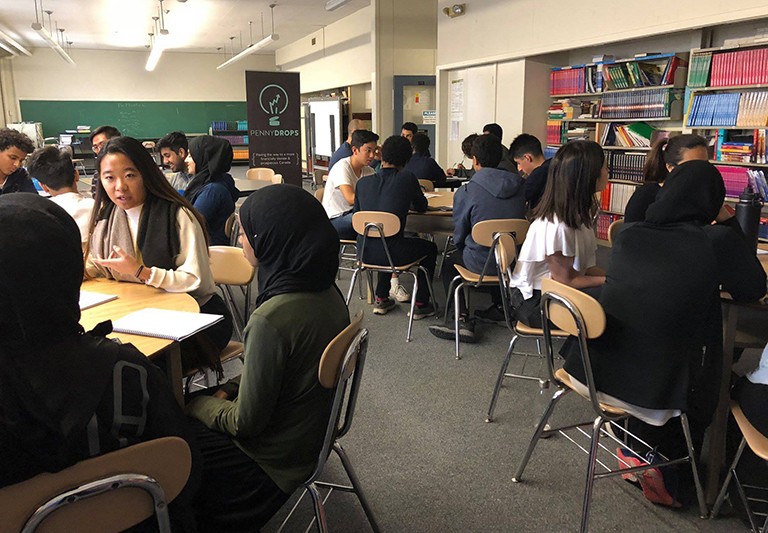

It’s a reality that student-run non-profit PennyDrops is working to change. Founded in 2015 at McGill University, the organization now has 19 chapters across Canada and is in partnership with BMO.

“Our goal is to equip Canadian youth with the knowledge and confidence to make informed financial decisions,” says Ariana Masse, John Molson School of Business student and chief marketing officer of the PennyDrops national team, based in Montreal.

“I was in high school when I realized I wasn’t being taught anything about taxes or getting a salary, so I had to learn that on my own,” she says.

The growth of PennyDrops in the few years since it started has meant the team has been able to reach more than 12,000 high school and 4,000 university students with its programming.

“Each chapter recruits mentors to teach Canadian youth financial literacy,” Masse explains.

“I was really motivated by the idea of helping students get a better and more well-rounded education on this topic than I got.”

Masse adds that students come out informed, but teachers are also very excited because they recognize the importance of the subject matter.

“Our mission is such an important one, because no matter what you do in life, once you graduate high school, everyone needs to manage their finances.”

Adapting to challenges

Following the shift to virtual learning due to the COVID-19 pandemic, the organization launched PennyDrops Anywhere — an interactive online platform that allows mentors to teach through video modules and pair their lessons with quizzes and activities.

“Typically, we would have mentors go into high schools in a workshop format with a few students paired with one of us. This was very engaging for students and what essentially set us apart from any other financial literacy program,” Masse notes.

PennyDrops Anywhere allowed the team to adapt and to modify the high school program to be taught through Zoom as well.

“This way, the teachers can pick what they prefer for their classroom, and either sign up for PennyDrops Anywhere, or have an online version of our high school program where our mentors teach it through Zoom.”

A richer Concordia experience

Masse believes that no matter students’ field of study, any involvement in student clubs can help round out their university experience.

“Being part of PennyDrops has allowed me to get real hands-on experience as a leader of a team and working with people,” she says. “It’s great to learn these things in class, but there’s nothing better than being able to apply it somewhere else.”

The PennyDrops team is currently recruiting for their national team and has numerous positions open for students across all departments. Applications close on October 2.

“It’s open to students from any major — we’re looking for Concordia students to bring something new to the team.”

Concordia students wishing to join the national PennyDrops team should fill out the online application form by October 2.