Over a century later such stories of giving continue to inspire. Hardeep Grewal, BComm 83, donated $1 million to his alma mater. Others are taking note.

In his speech to graduating students at all 14 spring convocations, McGill’s chancellor Michael Meighen quoted an opinion piece penned by Grewal for The Globe and Mail about his decision to give back.

“It’s high time for Canadians to stop just liking their universities and to start loving them,” said Meighen, mirroring Grewal’s words. Meighen went on to emphasize the importance of being active supporters of higher education.

As Quebec universities deal with a fourth consecutive year of budget cuts, philanthropy is an increasingly crucial means of moving forward. A different opinion piece written by the chancellor of the University of California at Berkeley, Nicholas Dirks, and published in The Chronicle of Higher Education summarizes it nicely.

“We need to find new, creative ways to support high quality public goods,” said Dirks in reference to universities. He adds how crucial they are to the health of our society as a whole — supplying research and human resources across the board.

Fundraising is a means of sustaining higher education’s offerings and service to its communities.

True to Dirks' call to find compelling ways to support education, a planned gift has much to offer — including immediate or future tax savings. A general suggestion I would give prospective donors is to direct taxable assets to a charity of their choice. Non-taxable assets should go to loved ones.

Planned giving is nimble. Donors have flexibility in defining the terms of their support. They are often surprised at the options available to them. A planned gift is not restricted to the future; it could also be immediate.

Regardless of what they choose, planned giving donors contribute to the public good while safeguarding their financial needs. It’s a win-win situation.

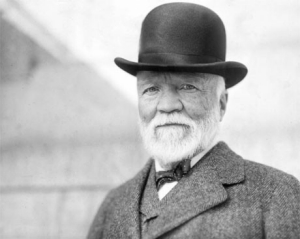

“No person becomes rich unless they enrich others,” said philanthropist Andrew Carnegie, who came from very modest beginnings.

“No person becomes rich unless they enrich others,” said philanthropist Andrew Carnegie, who came from very modest beginnings.

Silvia Ugolini

Silvia Ugolini